Creating Your Spending Plan

Up to this point, you should have been tracking all of your expenses and putting them into categories for your spending plan. In this post, we are going to break down your spending, look at your cash flow and spending ratio recommendations.

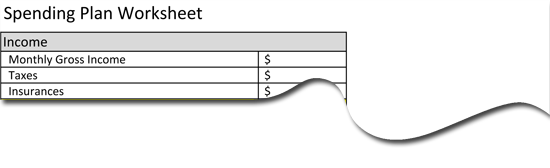

The first part of your spending plan is your income. You need to start off with your gross income. This is all of your income without any deductions. Make sure to include child support, alimony, social security, pension, work, or any other form of income. Some people have a base wage plus a bonus or commissions. I receive both of those and I have decided to not include my bonus or commissions into my spending plan. I consider that just extra money to put towards debt, savings, retirement, or our family vacation fund. That is your personal decision on what to include in income. Now you need to get your net income. This is how much money you bring in after taxes and insurances. I will not include investments in this because I have a total separate category for that in the spending plan. The reason for getting your net income is that our recommendation for spending is based on category and net income. Let me explain.

If you go online and search for spending plans you will find many websites talking about spending categories and ratios. There are 6 main spending categories.

| Category | What is included? |

| Housing | Mortgage, rent, taxes, insurance, repairs or improvements and all utilities |

| Transportation | Gasoline, repairs, public transportation and insurance |

| Debt | Credit card payments, student loans, automobile loan or any other debt payments |

| Savings | 401(k), savings, retirement, children education funds, IRA or any other investment vehicle |

| Food | Food |

| Other | Healthcare, entertainment, clothing, life insurance, or any other expense |

You need to know how much you spend in each of these areas. This is why tracking your expenses is so important.

I am including a spending plan template below. You will need to click on the image to download the file. It is an excel sheet for you to enter in your income and expenses and it will do all the calculations for you. If you don’t have Microsoft Excel you can go to www.openoffice.org and download their software for free and the file will work with that also.

After you have your income and expenses, you need to pay attention to Cash Flow. Cash flow is your income minus your expenses. Cash Flow is either positive or negative. It is positive when you have more income than expenses. It is negative if you have more expenses than income. If it is positive, you are doing great. You do need to figure out how to wisely spend that extra money. If it is negative, you need to find a way either to increase your income or to reduce your expenses. At this point you are not saving enough money and when it comes to retirement you will be hurting.

The last part of your spending plan is spending ratios. A spending ratio is a percentage of spending divided by net income. For instance, each category has a recommended ratio. For housing the recommended spending ratio is 35%. That means the total housing expenses divided by the net income should be less than 35%.

| Ratio | % Recommendation of Net Income |

| Housing | 35% |

| Transportation | 15% |

| Debt | 5% |

| Savings | 10% |

| Food | 15% |

| Other | 20% |

Now that you have created your spending plan you might need to make some adjustments. Remember that everything can’t be changed overnight. You need to take all of these things in steps. Recognize your progress and you will be more successful in reaching your goals.