Debt Ratios

Lenders look at several different factors when determining who to lend to and what terms to extend for the loan. The lender uses your credit score to understand your payment history. Your credit score just shows your history and does not reflect your income or your debts. You could have a high income and a low credit score. You could have a great credit score, but have over extended yourself with debt and could be on the verge of missing payments. This is why lenders look at income, debt and your credit score.

The majority of lenders use two common debt-to-income ratios to determine your eligibility for a loan. Debt-to-income is often referred to as DTI. Your DTI is the amount of debt you have compared to your overall income. They use what is called a front-end and a back-end ratio.

Back-End Ratio

The back-end ratio is all of your monthly recurring debt obligations. This includes car payments, minimum monthly credit card payments, student loans, expected housing payments (home equity line of credit, first and second mortgages, PMI, taxes, insurance and homeowner association dues) and any other loans you might have. These are only debt obligations not bills such as utilities, gas, etc. Then take this total and divide it by your gross monthly income and you have your back-end ratio. The standard for this ratio is that you can’t exceed 36%. There are some exceptions, but for the most part this is the standard. An easy way to think of what you can have and what your ratio is to use the following formulas:

Allowable Debt

(Gross Yearly Income x .36) / 12 = Maximum Monthly Debt Obligations

($80,000 x .36) / 12 = $2,400

Actual Back End Ratio

All Monthly Recurring Debt Obligations / Gross Monthly Income = DTI

($1,500 expected housing payments + $300 car payment + $50 credit card payment) / ($80,000 Gross Yearly Income / 12) = .28 or 28% Front End Ratio

Front-End Ratio

The next ratio is the front-end ratio. Once again, there are some exceptions, but the standard for this ratio is 28%. For this one they only look at your expected housing payments (home equity line of credit, first and second mortgages, PMI, taxes, insurance and homeowner association dues) divided by your gross monthly income. Here are the formulas for this ratio:

Allowable Debt

(Gross Yearly Income x .28) / 12 = Maximum Monthly Debt Obligations

($80,000 x .28) / 12 = $1,867

Actual Front End Ratio

Expected Housing Payments / Gross Monthly Income = DTI

$1,500 expected housing payments / ($80,000 Gross Yearly Income / 12) = .22 or 22% Back End Ratio

These two ratios are what the lender will use to accept or decline your request for a loan. If they do accept you they will then use them to determine the terms of your loan. The closes you are to the ratios the higher an interest you might have to pay. There are two ways to lower these ratios. The first is to increase your income. The second is to lower your monthly debt obligations. Both of these can be very hard and slow to do. The best way is the watch your ratios and make sure that you stay away from the limits.

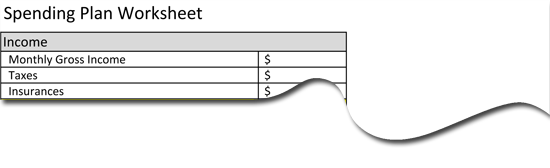

Previously, we shared with you a sample spending plan to help you with your spending habits. We took this spending plan and have added two sections for debt ratios. As you enter your information into the spreadsheet you will automatically update your ratios for you. This worksheet builds upon the previous one. Click on the image below and you will be able to download the spreadsheet. You can always go to www.openoffice.org to download free software to view and edit this document.

i love your blog, i have it in my rss reader and always like new things coming up from it.