Principle 5: Credit

Your credit history is included in your credit report. Reporting agencies, credit bureaus, use this information and their proprietary formulas to create for you a credit score. This is a numerical value that determines the risk you provide in lending you money, renting you a place to live or even determining if you are a reliable employee. Your credit score can dramatically impact your financial goals. Paying attention to your credit might be one of the biggest impact items to financial future.

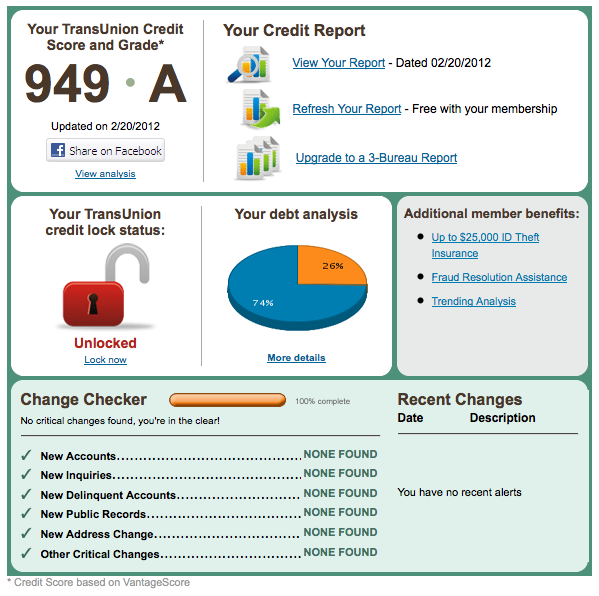

TrueCredit Credit Monitoring

Posted by BeingPreparedAdmin on Feb 21, 2012 in Credit | 0 comments

There are plenty of companies offering credit-monitoring services. You can turn on your TV and hear them advertising with their catchy jingles. I have tried out a lot of these companies to figure out which one offers the features I want. In this article I decided to share with you my review of TransUnion 3-Bureau Credit Monitoring , also known as TrueCredit. TrueCredit is a credit report and credit monitoring service provided by TransUnion.

Pros:

- For $16.95 per month you can get 24/7 credit report updates for all 3 major credit bureaus: TransUnion, Experian and Equifax. You also get unlimited updated credit reports. You get a free 7-day trial before you are charged for the services.

- You get your free TransUnion VanatgeScore. The VantageScore was created by all 3 credit bureaus and comes with a number and letter grade.

- Debt Analysis: this is a great feature that allows you to compare your debt ratios to the standards used by lenders. There are two parts you must complete before you get your simple analysis.

- Step 1: Enter you gross monthly income.

- Step 2: Choose which debts you want to include. It will automatically pull in the monthly debt amounts from your report. The good thing is that you can add, delete or modify monthly payment amounts to see how this will affect your debt ratio.

- After you complete this you will be provided your analysis. It is very simple and gives you some education, but it is a great feature to understand your debt ratio.

- Credit Lock: this feature gives you the ability to unlock and lock your TransUnion credit report. This is done by a simple click of the mouse. This allows you to determine who can see your credit report and when. This also prevents Identity Theft.

- $25,000 ID theft insurance comes with the credit monitoring service.

- Trending: This cool feature shows you trends from your credit report over time. The trends that are included are: available credit, balances/payments, delinquencies, inquiries, total debt and debt-to-income. Along with the trends they provide education on what the trends mean to you.

Cons:

- The free trial does not include all three credit reports. It only includes your TransUnion credit report. You will not be able to unlock all the features until the 7-day trial period is up or you opt of the trial period.

- The problem with the VantageScore is that lenders do not use this score. They use FICO score when determining if you are approved and at what terms.

TrueCredit is a great service for you to get a free copy of your TransUnion credit report and VantageScore. It has great features, debt analysis and trending; that I haven’t found in the other services I have tried. You can purchase your FICO score for an additional fee. All in all, TrueCredit is a great service for the price.

Why Credit Monitoring?

Posted by BeingPreparedAdmin on Feb 20, 2012 in Credit | 0 comments

We have talked before about the importance of credit in your everyday life. There are three main things that could be adding negative information to your credit report: your behavior and actions, identity fraud/theft and errors. At some point we have to understand that the reason our score is low might be because of our behavior and actions. I know the economy fluctuates and at times you may no...

How Negative Items Affect Your Credit Report

Posted by BeingPreparedAdmin on Feb 6, 2012 in Credit | 0 comments

As we have talked about credit can affect almost every aspect of your life. Here is one more example of how credit affects you. This is taken from GMAC Insurance. This is the explanation of why a credit score affects your car insurance rates. These are from the FAQ section about credit. “Do all car insurance companies use credit? GMAC Insurance uses credit to determine your auto insurance qu...

How Influential is Your Credit Score?

Posted by BeingPreparedAdmin on Feb 2, 2012 in Credit | 0 comments

As mentioned previously, your score can affect almost every aspect of your life. I wanted to share an example of how a credit score can affect your life. Mortgage Several big names pop into my head when I think of mortgages. One of these names is Lending Tree. They act like a dating service for mortgages. You go to their website and they will connect you with multiple lenders that can help you...