The Effects of Waiting to Save for Retirement

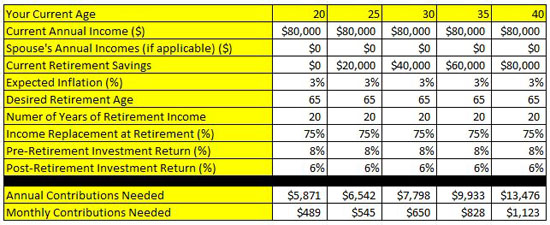

I was reviewing some financial calculators I was going to implement into the website and decided to do a little experiment. I went through 5 different scenarios of saving for retirement. I did this for ages 20, 25, 30, 35 and 40. Each person was to get the same returns on their investment, have the same inflation rate, have the same retirement age and live for the same amount of time after they retired. What I did change was the date at which they would start saving and as the age increased I even gave them more savings. I did not include any social security or pension benefits for these people. Look at the chart below to see what I found.

This shows the power of time. The longer you wait to start saving for retirement the more you will have to invest on a monthly basis. The difference between starting at 20 years old and waiting until 40 years old is $634 per month. Over the time that the 20 year old is saving that amounts to an additional $190,200 he will end up having extra because he didn’t wait to save.

The point of this exercise was to demonstrate, on a very basic level, to SAVE EARLY FOR RETIREMENT!