Principle 9: Retirement Planning

Many young people think of retirement as something far off that can be thought about another day. This mentality can be very harmful to your financial goals. In 2011, the American Institute of Certified Public Accountants released a report showing that 40% of working Americans will never be able to afford retirement, 55% said they did not know how much to save for retirement and 56% said they were not savings due to higher prices of consumer goods. Retirement is one of the most important events to happen in our life. From a financial perspective, achieving your retirement lifestyle goals is an extensive process that takes planning and financial discipline. The best time to start retirement planning is now so you don’t end up a statistic.

The Effects of Waiting to Save for Retirement

Posted by BeingPreparedAdmin on Apr 27, 2012 in Retirement Planning | 0 comments

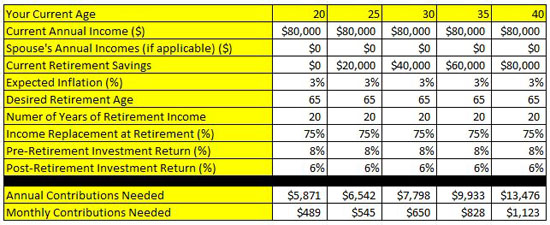

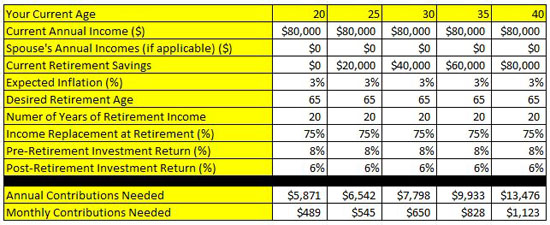

I was reviewing some financial calculators I was going to implement into the website and decided to do a little experiment. I went through 5 different scenarios of saving for retirement. I did this for ages 20, 25, 30, 35 and 40. Each person was to get the same returns on their investment, have the same inflation rate, have the same retirement age and live for the same amount of time after they retired. What I did change was the date at which they would start saving and as the age increased I even gave them more savings. I did not include any social security or pension benefits for these people. Look at the chart below to see what I found.

This shows the power of time. The longer you wait to start saving for retirement the more you will have to invest on a monthly basis. The difference between starting at 20 years old and waiting until 40 years old is $634 per month. Over the time that the 20 year old is saving that amounts to an additional $190,200 he will end up having extra because he didn’t wait to save.

The point of this exercise was to demonstrate, on a very basic level, to SAVE EARLY FOR RETIREMENT!

Posted by BeingPreparedAdmin on Dec 21, 2011 in Retirement Planning | 0 comments

After maximizing your tax advantaged retirement accounts, you should use other investments to grow your nest egg. There are numerous ways to additionally invest your money: stocks, bonds, mutual funds, creating your own business, other securities and real estate. As with your entire retirement investments you should focus on diversifying your portfolio to reduce the risk of having all your mo...

Posted by BeingPreparedAdmin on Dec 21, 2011 in Retirement Planning | 1 comment

There are many ways to invest for retirement. One effective and smart way is to use tax advantaged retirement accounts. The main purpose of these accounts is to help your money grow faster through reinvesting the monetary gains without being taxed until you withdraw from your account. Depending on the type of account there are also immediate tax benefits. This increases the effects of compounding ...