Principle 2: Debt Elimination

Most people have some type of debt. Some forms of debt are a mortgage, a student loan, an auto loan and credit cards. Debt gives you access to money you do not currently have. You will not only have to return that money, but also pay any interest or fees attached to borrowing that money. Debt is not bad as long as you manage it to certain levels and are working to pay it off. When the debt exceeds those limits, is a burden to you, or endangers your financial health, it is time to eliminate that debt.

Paying off Debts Using Snowball Effect

Posted by BeingPreparedAdmin on Jan 30, 2012 in Debt Elimination | 0 comments

One of the greatest sources of happiness I have is teaching others. I notice that when I teach others I learn more than they do. I also enjoy seeing the light bulb go on in others. Watching them go from lack of knowledge to complete understanding. I felt this way this weekend and I wanted to share that experience.

I have been helping a relative get their finances under control. We went through the bills this weekend and found out that he had four credit cards. This was discouraging for him because he didn’t know how he was going to pay them off. Debt can really deflate your self esteem really fast. The interest you pay can be extremely high and it can feel like you will never be able to pay it off. I feel there are two steps to paying your debt off and relieving yourself of these feelings. The first is to stop using those credit cards. The second is to create a payment plan.

I read on one of the statements that if minimum payments were made and no other charges were made the card would be paid off in 2 years. That was only for a balance of $350. I have worked in the finance industry for 13 years now and the past 6 years dealing with credit. I have had people ask me if they follow the steps I outlined for them in building their credit could I guarantee them good credit. My answer is always no. The reason is that you can follow all the steps and still not pay your other bills, get new credit cards or do something else and your credit will not improve. The same goes for your debt. If you set up a payment plan and continue to charge you will not pay off that debt.

There are two philosophies about how to pay off your debt. The first philosophy is to start with the highest interest rate debt and pay that one off first. After paying off that one, focus on the next highest interest rate. The second philosophy is to start with the lowest balance regardless of interest rate. Once that one is paid off then begin to pay on the next lowest balance.

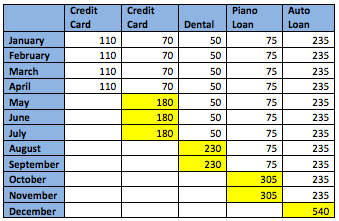

I have to agree with the second philosophy. This comes from personal experience. As I left college I had four student loans. The interest rates and amounts differed and I decided to pay equal amount to each one. I thoroughly became discouraged as I watched each one slowly go down. I know that the principal amount was going down the same if I just was paying on one, but I couldn’t get excited by such little movement. I decided to pay the minimums on one and put all extra money towards the lowest balance. It was all psychological. I wanted to see progress and as I saw one go down faster I felt hope that I could pay them down. I can remember each time I paid one off and the relief I felt. Once I paid one down, I didn’t pocket that money. I took the first payment and added it to the second. This creates a snowball effect. As you combine payments the overall balance decreased faster. You do this until your debt is completely paid off.

Below you will find a simple illustration of what I am talking about. The yellow is applying the debt you just paid off to the next balance.

After you have paid off your debt you can take those payments and apply it to retirement, family vacation, children’s education funds or whatever you like. Just make sure not to get yourself back in the same situation.

Debt Ratios

Posted by BeingPreparedAdmin on Jan 19, 2012 in Debt Elimination | 1 comment

Lenders look at several different factors when determining who to lend to and what terms to extend for the loan. The lender uses your credit score to understand your payment history. Your credit score just shows your history and does not reflect your income or your debts. You could have a high income and a low credit score. You could have a great credit score, but have over extended yourself with ...

Basics of Debt

Posted by BeingPreparedAdmin on Dec 6, 2011 in Debt Elimination | 0 comments

Most people have some type of debt. Some forms of debt are a mortgage, a student loan, an auto loan and credit cards. Debt gives you access to money you do not currently have. You will not only have to return that money, but also pay any interest or fees attached to borrowing that money. Debt is not bad as long as you manage it to certain levels and are working to pay it off. When the debt exceeds...