Find our How Your Credit Score is Determined

Credit Bureaus

There are three main credit bureaus – Equifax, Experian and TransUnion. They collect data and compile it into personal credit files for over 150 million Americans. The bureaus take this information and sell it to lending institutions, property management companies, credit grantors and other businesses. These businesses will provide information, such as payment history, to the bureaus. For instance, American Express will pull my credit report to decide if they want to give me a credit card. After granting me a credit card, they will report my balance, credit limit and both positive and negative payment history to the bureaus.

There is a common misconception that the credit bureaus are government entities. This could not be farther from the truth. There are government agencies that enforce regulations that affect the bureaus and provide oversight, just as with banks, but the credit bureaus are for profit companies. Their only role is to provide information that they have gathered.

Credit Report

We mentioned this in an earlier article, but I wanted to remind you of what makes up the credit file these bureaus are creating for you. Your credit report will include personal information and information about your credit history. Here are the five sections:

- Personal Information – this includes your name, address, social security number, date of birth and employment information.

- Trade Lines – this includes your credit accounts. This will have the open date of the account, account type, your credit limit, current balance and payment history.

- Public Records – this includes any public information from the court system. These can include bankruptcies, liens, judgments, garnishments, etc.

- Collections – this includes information on bad debt from collection agencies.

- Inquiries – this includes a list of everyone you have given permission to review your credit report when applying for credit. It will also include anyone that has viewed your report for pre-approved credit offers you receive through the mail. This shows the history of inquiries for the past two years.

Credit Score

It seems like almost anywhere you go you hear about credit scores. Whether you are going to rent an apartment, buy a home, get a cell phone, or go through almost any financial application, your acceptance will be dependent upon your credit score. Your score is a numerical expression of how risky you are as a borrower.

Just to be clear, the most widely used credit score is the FICO score. Fair, Isaac and Company developed the FICO score. Even though many companies have used their own formulas to come up with their own scores, most companies use the FICO score as the standard. From here on out when I refer to credit score I am talking about the FICO score.

It is important to note a couple of things about your credit score. The credit score only looks at information contained in your credit report. It will not take into consideration items such as your income, your education, and personal information in your credit report or anything else that is not included on that report. It will also only take into account certain items on your credit report. There are 5 main factors that determine your credit score.

Payment History

The largest factor in determining your credit score is Payment History. It accounts for 35% of your credit score. This includes both your positive and negative payment history. The more negative items that appear the lower your score will go. Your score will be affected differently by the severity of the item and how recent that negative item is. The types of items that will affect you are:

- Late payments

- Collection Accounts

- Public Records: Bankruptcy, judgments, liens, garnishments

- Charge-offs

- Paying all of your items on time

Amounts Owed

This is the second largest factor at 30%. This most refers to your utilization ratio. The utilization ratio is the total of all your debts divided by the total credit limits.

Utilization = total debt amounts / total credit limits

$8,000 debts owed / $10,000 credit limit = 80% utilization ratio

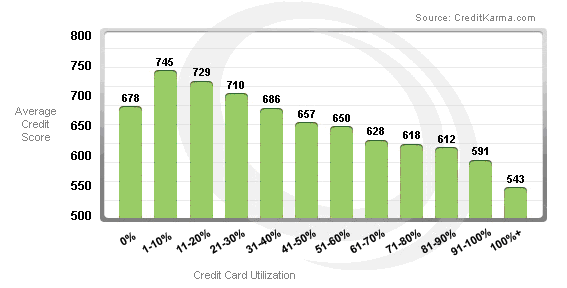

The credit score is tricky in that it doesn’t look at all the types of debts the same. It will look at different types of accounts, revolving accounts (credit cards) or installment accounts (auto loan), and treat them differently for the credit score. Having a lower utilization is better for your score, but going all the way to zero can have a negative affect. I found an interesting study done by CreditKarma.com. They looked at over 70,000 credit scores and came up with the correlation between credit score and utilization. The interesting thing is that having 0% is not good because it is showing you are not using credit.

Length of Credit History

This accounts for 15% of your credit score. Basically, the longer the credit history the better for your credit score. The main factors affecting your length of credit history are average age of all your accounts, the age of your oldest account, and how long since you have used these accounts.

New Credit

This part accounts for 10% of your credit score. There are two types of inquiries that show up on your credit report:

Soft Inquiries:

This refers to a company inquiring about your credit history and does not affect your credit score. When you receive a letter in the mail saying you are preapproved for a credit card the credit card company probably conducted a soft inquiry to prequalify you for the mailer. You usually never know these happen and they do not affect your score.

Hard Inquiries:

A hard inquiry does affect your credit report. This happens when a lender pulls your credit report for a loan or other credit qualifying transaction you have requested.

There is time limitations that this can affect your credit score, but be wise with how many items you are applying for. Each one will bring down your score.

Types of Credit Used

This one equals new accounts in importance at 10%. This looks at the number of accounts you have by type (installment loans and revolving accounts). You should have both, but don’t go and open accounts just to have an even amount of accounts. This will end up hurting you more.

There is one important thing to remember. Your credit score and go down dramatically very fast, but it takes a long time to build a good credit score. Be wise in what you do so you don’t have to spend all the time, heartache and energy in working on improving your credit score.