Why Credit Monitoring?

We have talked before about the importance of credit in your everyday life. There are three main things that could be adding negative information to your credit report: your behavior and actions, identity fraud/theft and errors.

At some point we have to understand that the reason our score is low might be because of our behavior and actions. I know the economy fluctuates and at times you may not be able to avoid bad things. I understand that illness can befall someone and you can’t do anything about it. I have watched this happen with my parents and it is devastating. Sometimes we create it ourselves. We need to evaluate situations and decide if there is anything I could have done to prevent this from happening. I have found when I do this that more times than not that I could have been better at preparing for the situation. Don’t always find blame and try to be more proactive.

Identity fraud or identity theft is a crime in which a person’s confidential, personal information is stolen for the purpose of criminal use, typically for economic gain. I have worked in the credit industry for over 13 years and have heard too many stories about identity fraud. I have even felt that pain myself. The problem with this is that it can affect the person for up to seven years before the negative items could come off of their credit report.

I want to include some data from the 2011 Identity Fraud Survey Report released by Javelin. The overall amount of identity theft cases decreased, but new account fraud increased. This is harder to detect and costs the victims the most amount of money. The average cost of fraud per incident increased from $387 in 2009 to $631 in 2010. Friendly fraud, friends or relatives, is on the rise. Nobody expects their friends or family to do this and the identity theft goes unnoticed longer. This is why the average amount per incident increases.

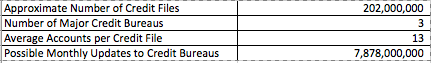

Errors are a huge reason why your credit score can be lowered. Remember that creditors send updates to the 3 major credit bureaus for their clients. The creditor chooses the time frame but this happens mostly on a monthly basis. So how many updates could be happening on a monthly basis?

That is correct. If every account was updated once a month that would be close to 8 billion updates per month. With that many transactions happening I believe there will be some errors. U.S.PIRG completed a survey on credit reports and errors. They found that 25% of credit reports surveyed contained serious errors that could result in a denial of credit. They also found that 79% of credit reports contained an error or mistake of some kind.

In Javelin’s report, they found that the consumer detected 48% of all reported identity fraud cases. Creditors and the Credit Bureaus are reporting errors. This points to the fact that your credit score can be changed without you knowing it. This is why credit monitoring is so important to your credit health. Credit monitoring provides real time updates to you about your credit report and score. I get updates via email and text. I can choose what types of alerts I want and how often I want to receive them. I would say that credit monitoring is a must with your credit scores being so important to you.